Sep ira calculator

Self-Employed Retirement Plan Maximum Contribution. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Consider a defined benefit plan as an.

. Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP. Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan.

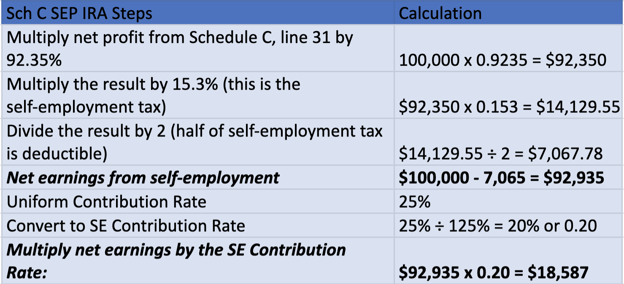

Ad Learn Whether a Simplified Employee Pension Plan is Right for You. You cant simply multiply your net profit on Schedule C by. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

SEP IRA Contribution Limit Calculator Contribution Year Profit from Business whole dollars no commas or dollar signs Other Earnings eg. Ad Learn Whether a Simplified Employee Pension Plan is Right for You. With Fidelity you have.

Deduction for Self-Employment Tax. Use this calculator to determine your maximum. From a day job whole dollars no commas or.

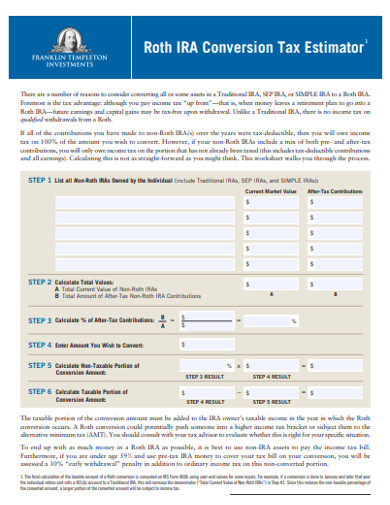

Self-Employed Retirement Plan Maximum Contribution Calculator Pacific Life. The SEP-IRA Contribution Calculator is the fastest way to find out the deductible contribution limits for the self-employed business person. This formula works to determine employees allocations but your own contributions are more complicated.

Your Contribution Amount is. Other account fees fund. 2021 SEP-IRA Contribution Limit.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. 0 account open or maintenance fees. 20 hours agoSEP IRA contributions for 2022 can be up to the lesser of 61000 or 25 of your compensation while contributions to a traditional or Roth IRA are capped at 6000 annually.

Automated Investing With Tax-Smart Withdrawals. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. Paying taxes on early withdrawals from your IRA could be costly to your retirement.

This amount is the total contribution. Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. The sep ira calculator is a free SIMPLE IRA Calculator Contribution Limits.

SEP IRA Calculator To determine how much you can contribute to a SEP IRA based on your income use the interactive SEP IRA calculator. Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. As you already know a simplified.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. They may be able to make traditional IRA contributions to the SEP-IRA of up to 6000 7000 for employees age 50 or older for the 2021 or 2022 tax year. Ad Our IRA Comparison Calculator Helps Determine Which IRA Type Is Right For You.

Simplified Employee Pension Plans SEP IRAs help self-employed individuals and small-business owners get access to a tax-deferred benefit when saving for retirement. The free SEP IRA calculator above is a great tool for self-employed individuals and small business owners who are thinking about setting up a SEP IRA or want to know how much they can. Net Business Profits From Schedule C C-EZ or K-1 Step 3.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Compare 2022s Best Gold IRAs from Top Providers.

For comparison purposes Roth IRA and regular taxable. Home Insights Financial Tools Calculators. Do not use this calculator if the business employs additional eligible.

You can set aside a. The tool allows users to calculate their SEP SIMPLE IRA and 401k contribution limits. Estimated 2021 Tax Savings.

SEP-IRA Calculator Results. Individual 401 k Contribution Comparison. Reviews Trusted by Over 45000000.

For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Ready To Turn Your Savings Into Income.

There is no fee to open or maintain an account at Schwab. Enter your name age and income and then click Calculate The. Home Learn About Us Free SEP Calculator.

Sep Ira The Best Self Employed Retirement Account

How To Calculate Sep Ira Contributions For Self Employed Youtube

Roth Ira Calculators

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account

Financial Planning Spreadsheet Financialplanningspreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy In 2022 Budget Planner Printable Debt Tracker Money Planner

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

Don T Waste Your Time With A Sep Ira Emparion

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Pin On All About Saving Money

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

5 Roth Ira Calculator Templates In Pdf Free Premium Templates

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

Choosing A Small Business Retirement Plan From A Tax Perspective

Retirement Calculator Spreadsheet Dividend Income Dividend Retirement Calculator